Medical Benefits

Welcome

Fenton Family Dealerships cares about the health and wellbeing of its employees. We are proud to offer you two different medical plans through Health Plans Inc. The two plans, Plan A and Plan B are designed to offer you comprehensive medical care and prescription coverage, along with the resources to help you maintain a healthy lifestyle.

Eligibility

All regular full-time employees working 30+ hours a week are eligible to enroll in health insurance. Eligibility for newly hired employees is the day following 30 days of continuous full-time employment.

Benefit Information

How do I enroll?

Open Enrollment is your time to make new benefit elections or make changes to your current benefit elections. During Open Enrollment, November 2022, your health insurance enrollment form must be completed through your ADP Workforce Benefits Portal.

Newly hired, regular full-time employees will enroll for health insurance benefits during the new employee orientation period. Eligibility begins the day following 30 days of continuous full-time employment.

Waiving or Declining Health Insurance

If you are eligible for health insurance and will not be enrolling because of alternative coverage, or choose not to have insurance, a waiver form must be signed during the enrollment period. If you elect not to enroll, you may not join the plan until the next enrollment period, November, 2023, unless there is a “qualifying event.” A Qualifying Life Event is a life-changing situation that allows you to make changes to your benefit elections, outside of the normal, Open Enrollment period. Examples of Qualifying Life Events include: the birth of a child, marriage, divorce and a loss of other coverage.

All employees should be aware of possible Federal tax penalties for declining Fenton’s health insurance plan enrollment, as well as alternatives for health insurance available through the Health Insurance Exchange. For more information about declining health insurance, see: https://www.healthcare.gov/get-coverage/ and http://www.valuepenguin.com/ppaca/exchanges/nh.

What happens if I leave Fenton Family Dealerships?

Under certain circumstances, you and your dependents may continue to participate in health coverage, dental insurance, and the Medical Flexible Spending Account through the Consolidated Omnibus Budget Reconciliation Act. COBRA is a federal guarantee of the continuation of health insurance plan coverage after employment ends, which allows you to remain on medical and dental coverage, at the employee’s expense, for up to 18 or 36 months, depending on the circumstances. Former employees who enroll via COBRA will be responsible for the full cost of the monthly premiums.

Summary of Benefits & Coverages

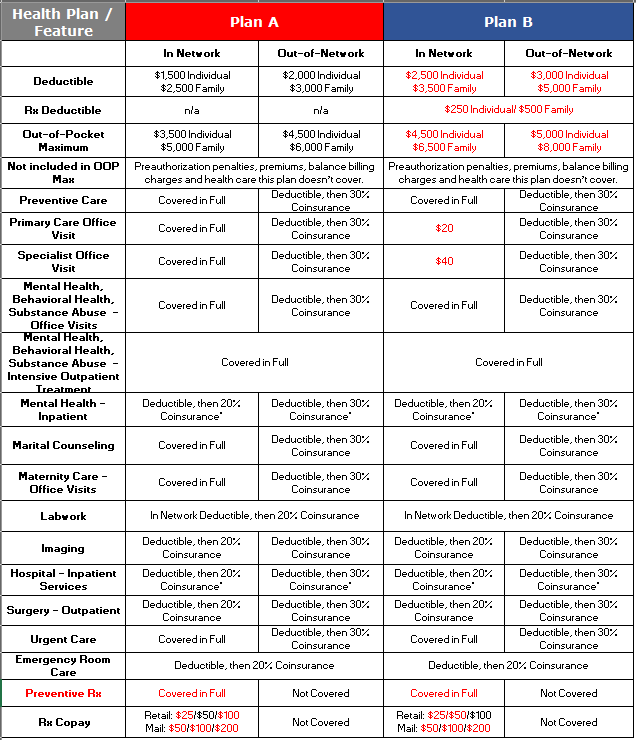

Fenton Family Dealerships is pleased to offer employees health insurance through Health Plans Inc. for the 2022 plan year. Fenton Family dealerships offers you two Preferred Provider Organization (PPO) plans from which to choose from.

There are three things to consider when choosing a Health plan.

Network – Both Health plans (Plan A and Plan B) options offer the same In-Network providers. Out-of-Network services are also covered, at a higher cost, under both plans.

Cost To Use – You will be responsible for Copays for primary care providers, specialists and prescription drugs with Plan B. With Plan A, only prescription drugs have a copay. Deductible amounts are lower in Plan A. Plan B also has a separate deductible for prescription drugs. With each plan you will pay 20% coinsurance after deductible for In-Network services, and 30% coinsurance after deductible for Out-of-Network services, until the out-of-Pocket Maximum has been met. The Out-of-Pocket maximum refers to the most you will pay for covered expenses under each plan. Plan A has lower Out-of-Pocket Maximums than Plan B.

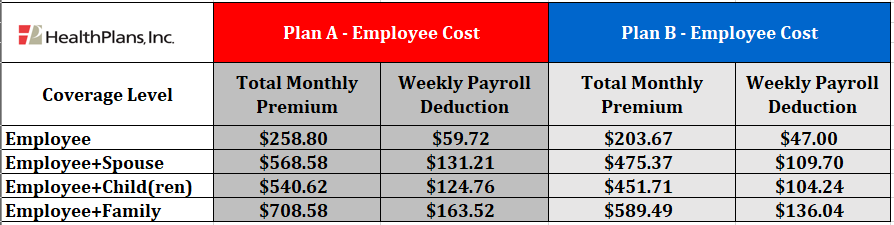

Cost To Own – The amount that will be deducted from each paycheck is listed below.

Contributions & Rates

The chart below shows the weekly payroll deduction for various coverage levels of the plan.

Effective 1/1/23 Fenton Family Dealerships Prescription Drug benefits will be managed by RxBenefits using CVS Caremark.

Who is RxBenefits?

Rx Benefits is a Pharmacy Benefits Optimizer. (PBO) They have partnered with CVS/Caremark to bring you greater discounts, better access, and improved member services.

What’s New?

You will have access to RxBenefits’ Member Services team Monday through Friday 7:00 a.m. – 8:00 p.m. CST. On weekends, after hours, and on holidays, members are given the option to speak with a CVS/Caremark representative or leave a message for the RxBenefits Welcome Team to return their call.

RxBenefits Member Services representatives are equipped to help you, your physician, and your pharmacy with questions such as:

• “Is my pharmacy in the network?”

• “Is my drug covered?”

• “How do I start using Mail Order for my medications?”

• “How do I get a Prior Authorization?”

• “Can you assist me with general benefit questions?”

For more information regarding RxBenefits contact the RxBenefits Welcome Team at 855-649-3641 or Welcome@rxbenefits.com.

You can also access your benefits and information by visiting Caremark.com/Start or downloading the CVS Caremark mobile app to explore all of the features.

How do I use my prescription benefits?

Fenton Family Dealerships’ medical plan includes coverage for pharmacy benefits. Your HPI health benefit plan ID card will also serve as your prescription drug card. Simply present your ID card and prescription at a participating retail pharmacy of your choice. The pharmacist will use your prescription and member information to determine your co-payment or coinsurance.

How do I access my retail pharmacy network?

RxBenefits offers access to a broad retail pharmacy network that includes thousands of pharmacies throughout the United States. That means you have convenient access to your prescriptions wherever you are – at home, work or even on vacation.

For a list of participating pharmacies, access your plan’s website for more information.

You’ll get the most from your benefits by using a participating pharmacy. Choosing a non-network pharmacy means you’ll pay the full cost of the prescription up front. Then you must submit a claim form to your plan for reimbursement.

Carrier Contact Information

Health Plans Inc: Medical Insurance

Customer Service: 888-335-9400

Website: http://www.healthplansinc.com

Plan Documents

Additional Information

Flexible Spending Accounts

Medical Flexible Spending Account (FSA)

What is a Medical Flexible Spending Account? A Medical FSA is a tax-advantaged employee benefit that allows eligible employees to voluntarily set aside pre-tax dollars through equal payroll deductions to be used for eligible health care expenses.

Who is eligible? The medical FSA is available to all regular full-time or part-time employees, whether or not they participate in Fenton Family Dealership’s health insurance. For new employees, eligibility begins the day following 30 days of continuous employment. If you choose not to enroll at that time, you must wait until the Open Enrollment for next plan year.

Eligible employees may elect to contribute up to $3,050 during the plan year, January 1, 2023-December 31, 2023.

Medical FSA Basics

- Medical FSAs are used to set aside money for planned or reoccurring qualified medical expenses that are not covered by insurance, such as dental care, vision care, contact lenses, co-pays, deductibles, out-of-network expenses. For a list of qualified expenses visit: https://www.irs.gov/pub/irs-pdf/p502.pdf

- Under the Coronavirus Aid, Relief and Economic Security Act (CARES Act), the definition of a qualifying medical expense now includes certain over-the-counter (OTC) medications and products. For some examples of these products, see the “Expanded FSA Expense” flyer.

- You have full access to your total election amount on the 1st day of that plan year. You do not need to wait until your FSA payroll deductions equal the amount of your qualified medical expense.

- Most transactions can be paid at the point of sale with a debit card pre-loaded with your total FSA amount for that plan year.

- Members have a grace period of 2 1/2 months from the end of the year to spend any unused FSA dollars. Once the grace period has ended, any remaining funds will be forfeited.

What is the most I can contribute?

- $3,050 for plan year 1/1/23-12/31/2023

- Payroll deductions are based on 52 paychecks per year.

- For new employees enrolling after January 1, the maximum allowable amount to be set aside is prorated. Payroll deductions will be based on the remaining number payroll checks in the plan year.

How do I enroll in the Medical Flexible Spending Account?

Whether you are enrolling for the first time, or continuing to participate in the new plan year, you would need to complete an HPI Flex Enrollment Form, to designate the total amount you have decided to set aside, and to acknowledge the weekly payroll deduction amount.

Once you have made an election, unless you experience a qualifying event, you are unable to make changes until the next open enrollment period.

Carrier Contact Information

Flexible Spending Accounts: Health Plans Inc.

Customer Service: 888-335-9400

Website: www.healthplansinc.com

Forms and Plan Documents

Dental Benefits

Eligiblity

All full-time regular employees who work a minimum of 30 hours per week are eligible, beginning the day following 30 days of continuous full-time employment.

Summary of Benefits and Coverages

Plan Overview

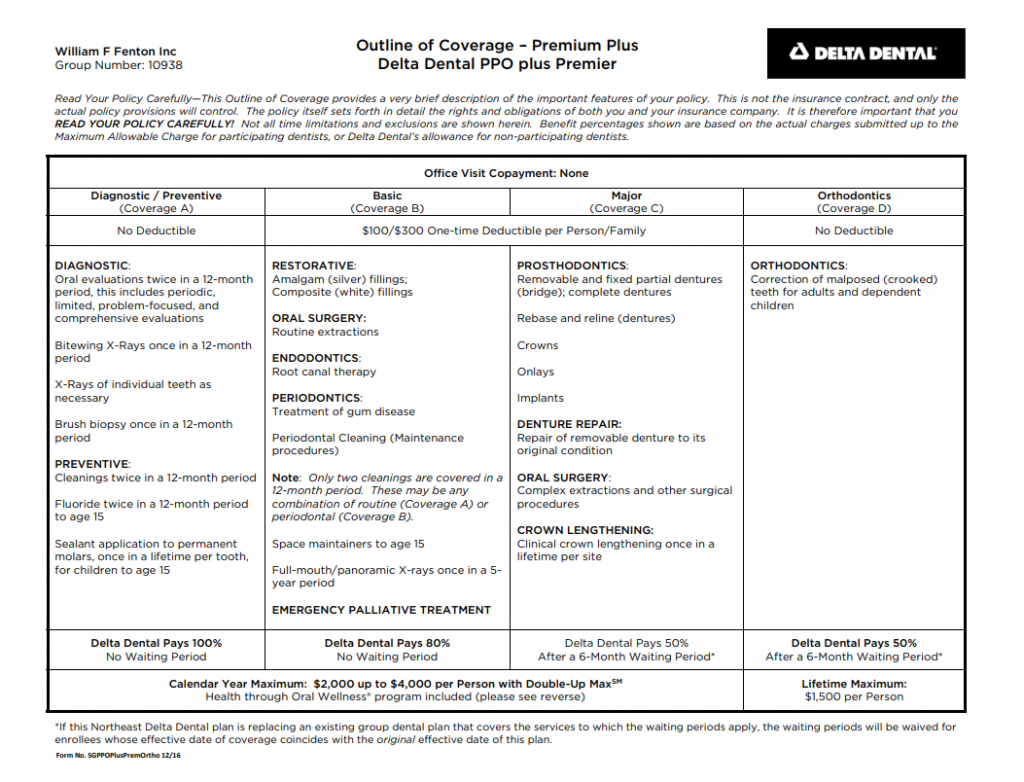

Fenton Family Dealerships offers it’s employees the PPO plus Premier plan through Northeast Delta Dental. The plan covers Preventive Care, Minor and Major Restorative procedures, as well as Orthodontia.

The chart below provides a high level overview of the dental plan design and features offered to eligible employees by Fenton Family Dealerships.

When considering whether purchasing dental insurance makes sense for you and your family, there are three things you should consider:

Network – Northeast delta dental has an extensive network. For a complete list of in-network dentists, visit https://portal1.nedelta.com/DentistSearch. In the “Network” field, enter “Delta Dental Premier”. If you visit a non-participating (Out-of-Network) dentist, you may be required to submit your own claim and pay for services at the time they are provided.

Cost to Use – There is no deductible for Preventive Services (Coverage A) or Orthodontia (Coverage D). For Basic services (Coverage B) and Major services (Coverage C) you will pay a one-time, Individual deductible of $100 or Family deductible of $300.

The annual maximum for the PPO plus Premier plan is $2,000 per member. The annual maximum may be increased to as much as $4,000 per person with the Double-Up Max program. See the attached Double-Up Max flyer for more information.

After meeting the deductible, you will be responsible for 20% of the cost of in-network Basic services, 50% of Major services, and 100% of all services once you’ve reached your annual max of $2,000, unless you benefited from the Double-Up Max rollover provision. You would be responsible for orthodontia costs beyond $1,500 per member, per lifetime.

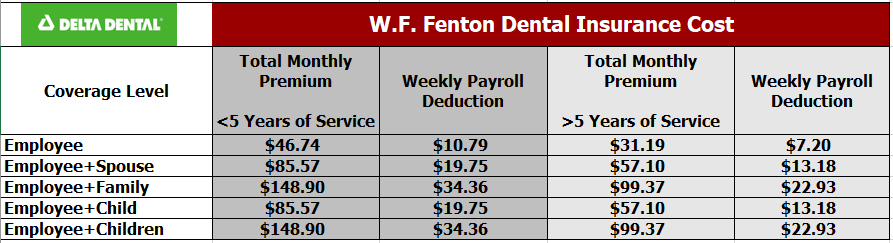

Cost to Own – What will your per paycheck deduction be? The amount that will be deducted from each paycheck is listed below.

Contributions & Rates

Enrolled employees pay 100% of the premiums through twice monthly payroll deductions.

With Dental Insurance, it might be helpful to conduct a cost-benefit analysis for yourself and your family before enrolling. Once you’ve determined your annual cost to own the insurance, based on the premium chart above, consider the following:

- How often do you and your family members receive preventive dental care?

- Do you expect to need major, non-cosmetic dental work in the coming year?

- Do you have a dentist you know and trust that is included in this plan’s network?

- Would making tax favorable elections/contributions to an FSA be a less expensive way for you to pay for dental care?

How do I enroll?

If you are electing coverage you’ll need to complete a Delta Dental enrollment form and submit to Human Resources.

Carrier Contact Information

Northeast Delta Dental: Dental Insurance

Customer Service: 800-832-5700

Website: www.nedelta.com

Plan Documents

Group Life Insurance

Eligibility

All Active, Full-Time employees who work 30+ hours per week are eligible beginning the day following 30 days of continuous full-time employment.

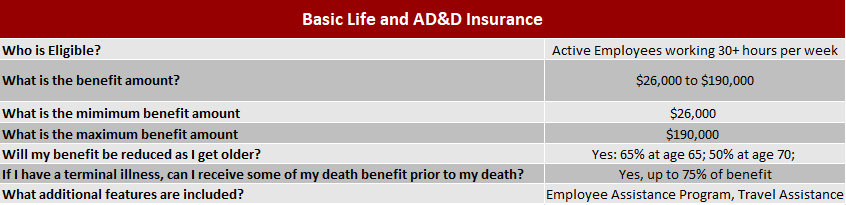

Summary of Group Basic Life and AD&D Benefits and Coverages

Insurance can play an important role in reducing financial stress when a family is faced with the pre-mature death or disability of a wage-earner.

To help employees during critical times of need, through The Hartford, Fenton provides employer paid Life Insurance to all regular, full-time employees who work 30+ hours a week. New employees become eligible on the first of the month following 30 days of employment.

Employees will have coverage of 1x times their salary with a minimum amount of $26,000, up to a maximum of $190,000.

Below is a table outlining the benefit coverage:

Supplemental and Dependent Life Insurance

Families have unique circumstances and financial needs. Fenton Family Dealerships offers its Full-time employees who work 30+ hours per week, the opportunity to elect Supplemental Employee Life Insurance, Spouse Life Insurance and Child Life Insurance.

- Coverage is $1,000 – $500,000 depending on the covered member (employee, spouse or child)

- Employee – $500,000 maximum (Not exceed 5x earnings for amounts over $150,000)

- Spouse – $250,000 maximum (coverage may not exceed 100% of employee amount)

- Employees will be required to submit a health application (EOI) if they elect coverage in excess of the guarantee issue amount

- Original Employee Supplemental Life benefit amount will reduce to 67% at age 70 and 34% at age 75

- Guaranteed issue amount (at initial eligibility period only) for Employee Supplemental Life is $130,000, and $50,000 for Spouse Life. All Child Life amounts are guaranteed issue.

- See the attached Supplemental & Dependent Life Monthly Premiums for a complete list of rates.

- Accidental Death and Dismemberment (AD&D) amounts will be equal to the Life coverage amounts.

Carrier Contact Information

The Hartford: Basic Life and AD&D

Customer Service: 800-523-2233

Website: www.thehartford.com

Contributions

Group Basic Life and AD&D is 100% paid for by W.F. Fenton.

Forms & Plan Documents

Long-Term & Short-Term Disability

Eligibility

All Full-Time employees who work 30 or more hours per week are eligible beginning on the day following 30 days of continuous full-time employment.

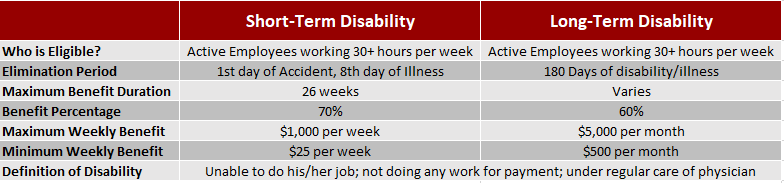

Summary of Benefits and Coverages

Most people don’t think about being disabled and unable to bring home their paycheck. Your financial obligations and living expenses don’t stop when you become disabled. Disability insurance can play an important role in reducing financial stress when facing the disability of a wage-earner.

To help you during critical times of need, through The Hartford, Fenton Family Dealerships provides employee paid Long-Term and Short Term Disability insurance to all regular part-time and full-time employees who work 30+ hours per week. New employees become eligible on the day following 30 days of continuous employment.

Below is a table outlining the benefits coverage:

Carrier Contact Information

The Hartford: Long-Term & Short-Term Disability Insurance

Customer Service: 800-523-2233

Website: www.thehartford.com

Forms & Plan Documents

Employee Assistance Program

Eligibility

All employees and their household members.

All employees who work a minimum of 30 hours per week are eligible beginning the day following 30 days of continuous employment.

Program Details

Fenton Family Dealerships promotes the health of employees and their household members by offering immediate access to free, confidential counseling through Invest EAP, for a wide range of life issues. Invest EAP provides support for overall health, well-being and life management, the EAP can assist employees and their household members with issues such as everyday stress, grief & loss, legal questions, financial concerns and relationship issues at work or home. EAP benefits are 100% confidential and available to all employees and their household family members.

What is Invest EAP?

• Employee, Family, and Organizational Assistance Program

• Free and confidential counseling, resources, and support for you

and your household members

• Sometimes people just need a little support or free help to resolve

personal stress or problems

• We are local to you and offer many of our services either in-person or via telehealth

Why do people call us?

▪ Counseling

▪ Resources

▪ Referrals

▪ Consultation

▪ Free legal referrals and

financial advice

▪ Use us as a sounding

board

▪ …And support for

anything else that’s on

your mind!

866-660-9533

Our call center is staffed by counselors and

behavioral health specialists, ready to take your

call any time of day or night

www.investeap.org

Password: fenton

Our website is a robust wellness portal with

articles, assessments, and a financial/legal

resource center

In addition, your Life Insurance policy through The Hartford, offers access to unlimited and confidential telephonic grief counseling, emotional support, legal and financial consultation when you need it most. Professional clinicians, who are experienced in dealing with grief, anxiety and depression are available to discuss any concerns and offer comfort to those in need of support.

For more information, go to www.guidenceresources.com

Or speak with a specialist at 800-964-3577

How to Access Services:

Visit www.guidanceresources.com to access hundreds of personal health topics and resources for childcare, elder care, attorneys or financial planners.

If you’re a first-time user, click on the “Register” tab.

1. In the Organization Web ID field, enter: HLF902

2. In the Company Name field at the bottom of the personalization page enter: ABILI

3. After selecting “Ability Assist Program”, create your confidential username and password.

EAP Contact Information

Invest EAP

Customer Service: 866-660-9533

Website: www.investeap.org

InvestEAP

Guidance Resources

Travel Assistance & ID Theft Protection Program

Eligibility

All employees who work a minimum of 30 hours per week are eligible beginning on the day following 30 days of continuous employment.

Program Details

Travel Assistance is offered to all eligible Fenton Family Dealerships employees and immediate family members through The Hartford.

Your Life Insurance policy, through The Hartford, offers access to 24/7 Travel Assistance. Whether you need help with an illness or injury, lost passport, missing luggage or even a prescription refill, you can rest assured you (and your covered dependents!) have access to a personal travel emergency companion anytime you’re more than 100 miles away from home. You also get Identity Theft Assistance which includes Prevention services, Detection services and resolution guidance.

Call 1-800-243-6108 for assistance.

EAP Contact Information

The Hartford Travel Assistance

U.S. Customer Service: 800-243-6108

Website: www.thehartford.com

Additional Information

401(k) Retirement Plan

Eligibility

Fenton Family Dealerships, through Empower Retirement, offers employees the opportunity to safely and conveniently save for their retirement by offering a a 401(k). Employee may choose to make Pre-Tax contributions or After-Tax (Roth) contributions.

Employees who are 18 years of age, have completed 6 months of service and have worked at least 500 hours will be automatically enrolled in a pre-tax plan at a rate of 3% per pay period.

401(k) Plan Details

In 2023, the Before Tax amount is between 1% and 100% of

your compensation or $20,500.00, whichever is less.

Participants turning age 50 or older in 2023, may contribute an

additional $7,500.00.

Vesting is the percentage you are entitled to receive upon a distributable event. Employee contributions are always 100% vested.

Fenton Family Dealerships provides for a match of 100% of deferrals up to 3% of compensation. All Employer contributions and any earnings they generate, are vested based on Years of Service.

The Vested Percentage of Employer Contributions are as follows:

0 – 1 Year(s) – 0%

1 – 2 Year(s) – 10%

2 – 3 Year(s) – 20%

3 – 4 Year(s) – 40%

4 – 5 Year(s) – 60%

5 – 6 Year(s) – 80%

6 Years and over – 100%

A wide array of investment options are available through your

Plan. Please review the Plan’s Notice of Investment Returns

& Fee Comparison for information on the investment options

at www.NADA401k.com.

For more details: See the attached 401(k) Plan Summary and 401(k) Plan Description.

EAP Contact Information

Empower Retirement

Participant Services: 855-756-4738

Website: www.empower-retirement.com

Additional Information

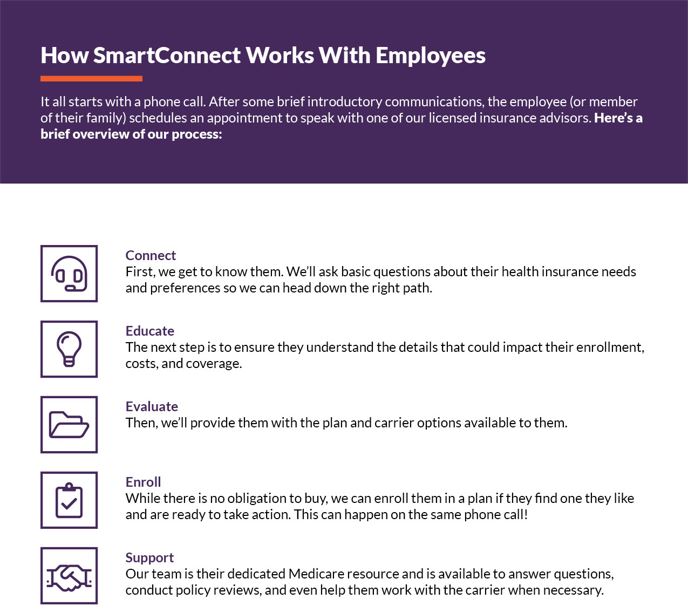

SmartConnect

Eligibility

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

Upcoming Webinar

SmartConnect Contact Information

For more information or to get started, please click on the following link: https://gps.smartmatch.com/

Additional Information

Pet Insurance

Eligibility

Eligibility for pet insurance is effective immediately upon signing up for this benefit.

Pet insurance is a health care policy purchased by a pet owner to help decrease the overall costs of expensive veterinary care. This policy covers the cost of treating unexpected illness and injury, administered by a licensed vet, emergency clinic or specialist.

The cost of Pet Insurance will vary depending on your animal, age and breed.

Why do I need pet insurance?

- Every six seconds, a pet owner is faced with a vet bill of over $1,000. For most, that’s a hard financial burden.

- Having a pet insurance plan helps owners afford vet care when their furry friend is sick or gets into an accident.

- Pet insurance can help owners make the decision between the life of their pet vs financial euthanasia.

- When deciding whether or not you need insurance, consider the cost of treatments without pet insurance.

What makes Pin Paws Pet Care different from other pet insurance companies?

- Coverage for cats and dogs of all ages and breeds

- No initial exam/past vet notes required

- Accident coverage starts at midnight

- Customizable deductible and out-of-pocket max

- Annual max payouts as opposed to per incident

- Choose your reimbursement percentage

- Multiple value-added benefits included

- Routine care options available with customized plans

Available in all 50 states

Enrollment Process

Enrollment is available at any time (not limited to Open Enrollment window or new hire eligibility).

To enroll, visit: PinPaws.com/ffdpets, and follow the steps for enrollment.

Depending on your dog or cat, and which plan you choose, your monthly premium will vary. You will need to pay with a personal credit card or bank account to sign up.

What Are the Steps for Filing a Claim?